Open Banking and Data Sharing

The Open Banking industry is expected to generate £7.2bn in revenue by 2022, 71% of SME’s and 64% of retail consumers are forecasted to adopt it over the same period according to Accenture.

Open Banking in the UK and the Payment Services Directive 2 (PSD2) enacted by the European Union (EU). Are government regulations that compels banks to open their historical and current customer data to 3rd parties.

Hence if an organisation creates a digital product or service that solves a problem for retail banking consumers and SME’s. That requires transactional data held within banks.

PSD2 compels banks to provide said firm with the information they need. Through an API. It also empowers consumers to instruct financial institutions to provide 3rd parties with access to their data.

The idea behind Open Banking is, that by liberating retail banking consumer data. This will foster the development of innovative products tailored to the needs of retail banking SME’s and B2C consumers.

How do API’s Work?

An API or application programming interface facilitates connectivity between, mobile applications. Hence if a consumer places an order for a book through Amazon, orders a meal via Deliveroo, or purchases a blue dress on Matches.com.

The API for each of the websites will send requests to the databases of the brands mentioned to determine the availability of the items. The results of querying the databases will then be sent to the API of the website before being presented to the consumer.

Hundreds of thousands of requests are transacted this way by consumers across thousands of websites every day.

Also, API's may be deployed when consumers interact directly with a brands website or indirectly, when a customer makes a request via an aggregator website.

Hence, when a consumer places a request on a comparison website. For example, Trivago, the API of the travel marketplace will send the request to the API of the websites of the brands that are part of the travel marketplace. This would also be true for financial services comparison sites, such as Money Supermarket.

The Difference between Open and Closed Banking API’s

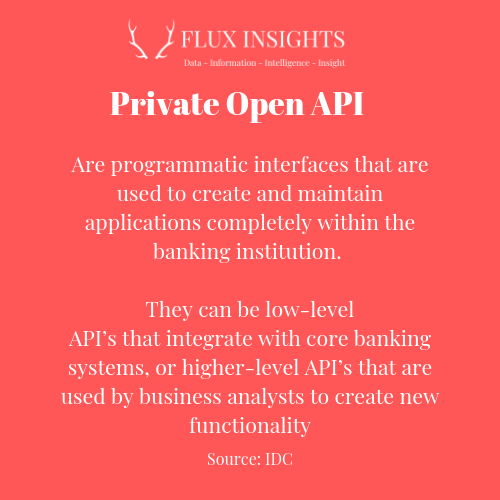

According to techtarget.com, a private API is an application programming interface that has its application hosted with in-house developers. Private APIs act as front-end interfaces to back-end data and application functions. The interface provides a point of entry for developers or contractors that are working to develop those functions.

Private API’s are about productivity, partnerships, and facilitating service-orientated architectures.

On the Partnership Front: In the context of partnership formation, companies expose part of their private API to their partners facilitating faster technical integrations.

Productivity: The provision of open architecture, enables developers to plug into the back-office systems, data and software. Speeding up the development process of engineering teams.

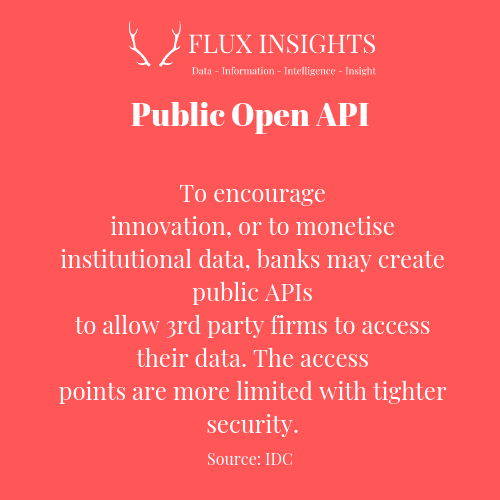

Public API’s include the Twitter API, Facebook API, Google Maps API. Firms that own the API’s, share their data with developers outside of their organisations.

Public API’s can be accessed by 3rd party organisations, that include but are not limited to fintech, utility organisations, housing organisations, and insurance organisations.

Data Sharing Practices

Data Scraping

The most frequent method used by FinTech’s and other third parties to access data is through a process called screen scraping. The Fintech records a customer’s login credentials for their online banking platform and then uses these details to log-in and impersonate the user to extract the desired data. However, there are downsides, such as;

* screen scraping does not allow customers to control the scope and duration of access to their data.

* Screen scraping may be perceived to violate the terms and conditions of customer accounts at financial institutions

* Screen scraping can be resource intensive

Bilateral Agreements

Bilateral agreements predominantly used in the USA. Between financial institutions and fintech’s are another method deployed by fintech’s to obtain consumer data.

These for profit agreements signed between banks and fintech’s or with aggregation service providers. Are not a panacea to ensure full and fair access to consumer data for FinTech’s and other non-banking organisations.

As, these agreements, may eradicate efficiency, restrict competition, stifle innovation and drive up costs.

Application Processing Interfaces (API’s)

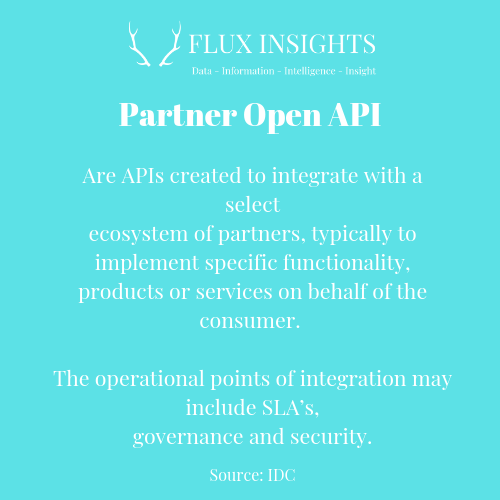

API’s are the next generation of data sharing. There are three types of APIs. Private API’s are used within the bank, reducing friction and enhancing operational efficiency. Partner API’s are between a bank and specific third-party partners, often able to enable specialised products or service lines. Open API’s are accessible by developers to build new products.

Types of Open Banking API’s

The Spanish banking giant BBVA is an example of a financial services institution that uses API’s as part of its Banking-as-Service (BaaS) platform in the US. The platform authorises third parties to gain access to a suite of banking services from BBVA, through application programming interfaces (API’s).

This enables the third parties to offer their customers financial products without the need to provide a full suite of banking services themselves. These organisations may be fintech or non-financial services organisations.

Singapore's DBS bank developed its own API platform, currently, it is the largest open API platform in existence today.

The organisation entered into a partnership with Xero to provide an API-driven service that enables SME's to reconcile all transactions and bank statement data in one platform. The company also created a platform for developers to create innovative applications.