Fintech and the Disruption of Financial Services

Presently, 30% of the world’s adult population is unbanked. 80% of SME’s worldwide have no access to formal financial systems and 90% of the adult population in developing countries do not have access to a credit card.

The International Finance Corporation (IFC) reported a funding gap of more than US$ 2 trillion for (SME’s) in emerging markets. Hence the World Bank and the G20 are collaborating to solve this challenge.

However, big tech companies along with Fintech start-ups are racing to capitalise on this huge market opportunity.

““Banking is essential, banks are not”

”

In countries across Europe, Asia and Africa where retail finance consumers are underserved by banks. This statement is being tested to its limits. In emerging markets, the substitution of banks by fintech and e-commerce platforms is already underway.

To illustrate, according to Mckinsey. In Korea, Kakao launched Kakaobank, building on its nearly 40-million strong chat user base in South Korea to acquire one million customers within the first five days.

The new bank also raised up to $3.6 billion in deposits and issued over $3 billion of loans in the first 100 days. It is now the fastest-growing mobile bank in the world with over 5.5 million users, $6 billion in deposits, and over $5 billion in loans issued as of February 2018.

Kakoabank is now expanding its portfolio into mortgage, credit cards, and new payments offerings.

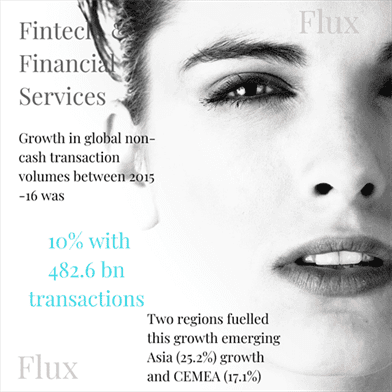

The Fintech Sector

The fintech sector consists of 9 main categories: Blockchain, Analytics, Deposits and Lending, Payment, Insurtech, Banking Infrastructure, Investment Management, RegTech and PropTech.

Currently, digital payments and alternative lending (including P2P lending) are the largest fintech segments respectively (Statista, 2018).

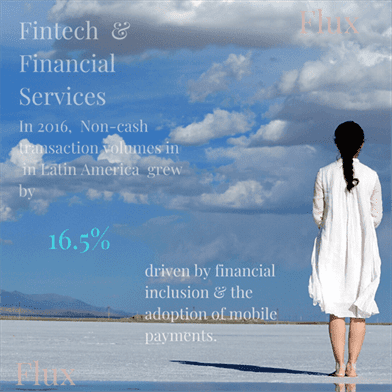

Chinese Fintech dominates three Fintech areas: online (P2P) lending; mobile payments and artificial intelligence. The on-going growth in consumers and SME’s seeking alternatives to banks to manage transactions and obtain banking services.

Is a significant opportunity for fintech firms. Driven in part due to the mass adoption of smartphones, falling data costs, changing consumer preferences and inefficiencies in the delivery of financial services.

“The unit cost of financial intermediation has remained at approximately 2% for 130 years. ”

Even after the financial crisis, financial intermediation costs declined only marginally. During this period, the burden of increased, capital requirements and compliance costs. Constrained the ability of banks, to lend to SME's and consumers. Ironically, creating an opportunity for tech-enabled non-banks to thrive.

Setting the stage potentially for what Mark Carney calls the banking industry’s “Uber moment”. That is the unbundling of banking financial services.

Also, for new market entrants, the economics of banking has shifted. The rise of cloud infrastructure, as a viable alternative to expensive data centres. And the extensive use of mobile channels. Essentially means, according to the World Bank.

“The provision of financial services no longer requires high fixed-cost mainframe data centres and branch networks”. Further lowering the barriers to entry, into the financial services industry.

Source: Fintech 100 2018 -H2 Ventures

Also, in Europe, to drive innovation, in retail finance, regulators, in the EU introduced the Second Payments Services Directive II (PDS2) and the Open Banking Standards.

To create an environment for banks and start-ups in the Fintech space to deliver innovative products and services centred around consumer data.

Changing Consumer Expectations

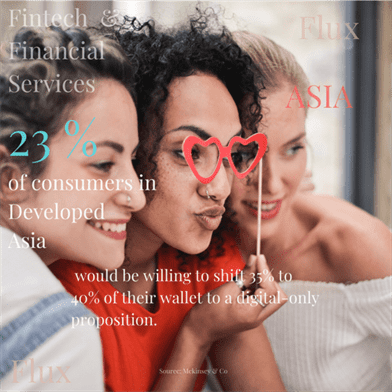

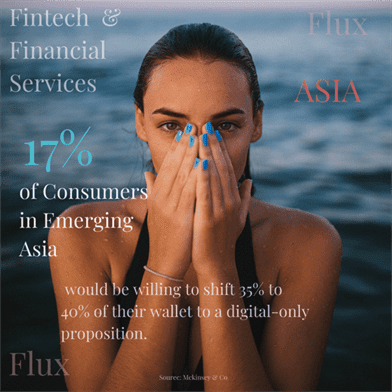

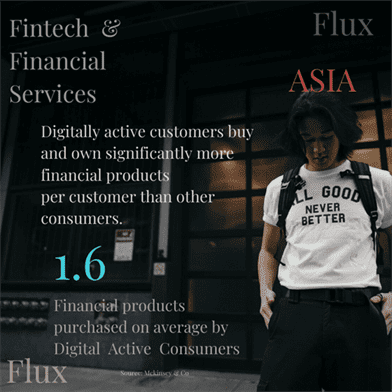

Digital transformation, across other industries, exposed consumers, to the convenience, and ease of use of tech-enabled digital products. Technology enabled organisations, such as Apple, Google, Amazon and Facebook offer products and services centred around convenience and usability.

This transformed consumer expectations and SME's, when interacting with financial service providers. They expect the same level of immediacy and customisable products and services.

These expectations centred around usability, personalisation and convenience are more extreme in millennials.

For example, research into consumer expectations by Consumer International in the USA. Found, a third of millennials surveyed believe they will not need a bank. Less than half have a credit card. One-third of US millennials have no saving accounts.

In Canada, millennials are 1.5 times more likely to switch banks, than the general population. The main driver, for switching for over 50%, was a poor mobile experience. This cohort, for the most part, trusts tech brands.

Furthermore, this cohort is displaying similar profiles, to that of consumers of Fintech services, in China. Insofar as, they have a mindset, indicating that they may not need a bank.

This group may be open to substituting bank accounts for digital wallets attached to multi-product tech platforms similar to Yu’e Bao, WeChat and Alipay.

According to Swift, the democratisation of financial services by innovative Fintech firms is enabled by four key factors:

(1) Changing consumer behaviour and expectations regarding financial services

(2) Artificial intelligence, cloud computing and big data created an affordable infrastructure

(3) The emergence of new digital currencies, credit systems are impacting investment and banking

(4) The wide adoption of mobile phones and the ascent of the mobile economy lowered barriers to entry into the financial services industry by new market entrants

China, the USA, UK, Japan and Germany are the dominant markets in the fintech sector in terms of the number of transactions.