Innovations in Payments the Chinese Story

Digital transformation, across other industries, exposed consumers, to the convenience, and ease of use of tech enabled digital products. When owners of SME’s and consumers, interact with retail finance products, They expect the same level of immediacy, with solutions customise to their requirements.

In the UK, the USA and Europe. Trust, in financial institutions, diminished as a result of the financial crisis, in 2008. In parallel, the burden of increased, capital requirements and compliance costs. Constrained the ability of banks, to lend to SME’s and consumers. Ironically, this created an opportunity for less regulated, tech enabled non-banks to thrive.

Innovation in China, and to a certain extent, in the USA, UK and EU. Can be found in the deployment by Fintech platforms, of new technological applications. Such as digital identities, digital currencies, and the blockchain. Including, the use of social media and mobile data, for the use of credit scoring.

The use of digital identities, digital currencies applications is more advanced in China. Than in the UK and the EU due to concerns around consumer privacy. However, last year, HSBC rolled out the use of facial and voice recognition technology to support user identification across parts pf its banking network.

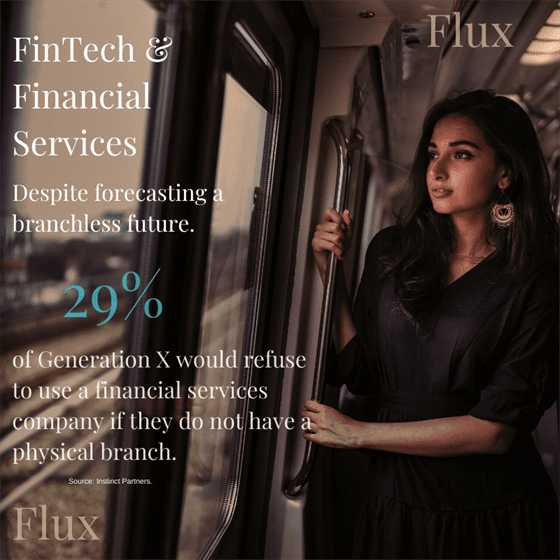

Also, the economics of banking has shifted. The rise of cloud infrastructure, as a viable alternative to expensive data centres. And the extensive use of mobile channels. Essentially means, according to the World Bank. That the provision of financial services no longer requires high fixed-cost mainframe data centres and branch networks. Further lowering the barriers to entry, into this sphere.

Hence, the emergence of SoFi, an online personal finance company offering career coaching. Revolut- better than your bank, in the UK. Is a financial technology company that offers banking services including a pre-paid debit card, currency exchange, cryptocurrency exchange and peer-to-peer payments platform.

The Revolut mobile app supports spending and ATM withdrawals in 120 currencies and sending in 26 currencies directly from the app. The company is reported to be seeking to raise US$500m in funding this year.

Another fintech firm, Circle is a P2P payments platform available as an app on iOS and Android devices. It’s cross boarder payments platform, enables consumers to send cash, from their app in the UK or Dublin to a US account at no cost.

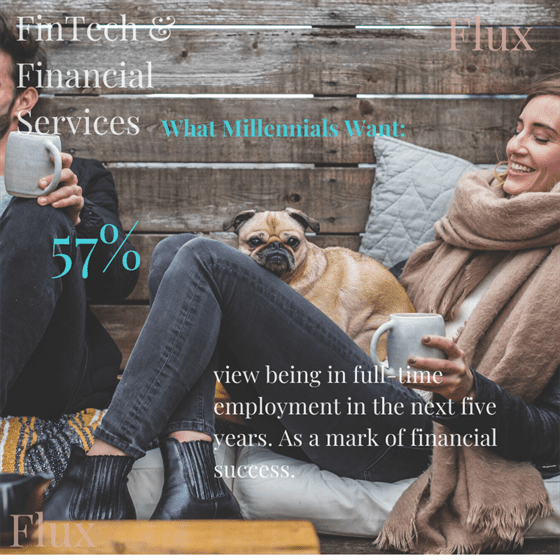

Changing Consumer Expectations – Generation Z

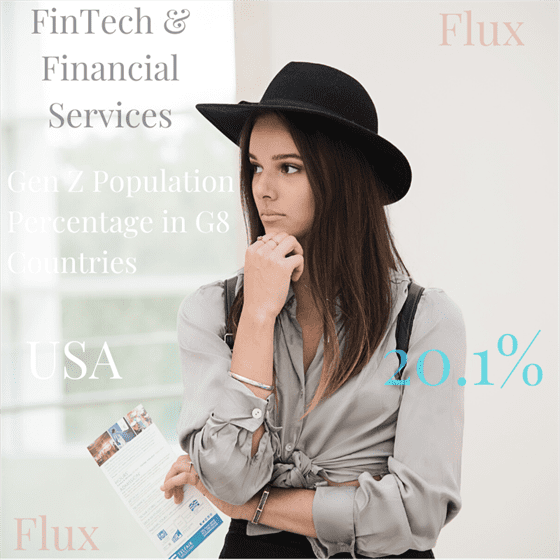

These are individuals born between 1995 and 2015. They are currently aged between 4-24 years old, there are nearly 74 million in U.S.

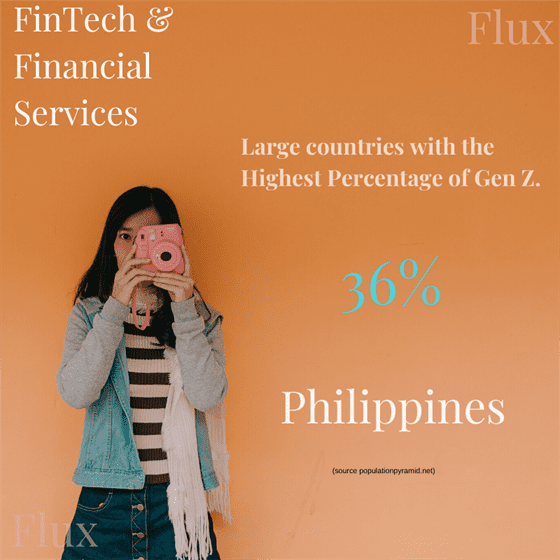

The largest generation Z populations are in some of the largest, youngest and most dynamic countries: namely India and China, but also Nigeria, Pakistan. Nigeria for example has 43% of its population in this generation, verses 13.5% in Germany. They are set to outnumber millennials by the end of 2019.

In a report by Accenture, titled “Beyond Digital: How Can Banks Meet Customer Demands?”. 41% of generation Z respondents, stated that they would consider purchasing banking services from an online provider. Such as Google, or Amazon. Also, in return for sharing their data, consumers, expect more personalised banking advice, that is automated and in real-time.

What Consumers Want from Banks

Consumers want to trust their banks, they are unimpressed with the user experience (UX) of banking products. They desire greater transparency, when interacting with products and services. And will not tolerate, hidden surprises. Finally, they want to engage in digital solutions that deliver convenience.

Companies that assist consumers to keep on top of their money include mint.com, personal capital.com and youneedabudget.com

Chinese Fintech Ecosystems

However, despite the desire by consumers in the USA, UK and the EU for innovative Fintech services from China. There may be impediments in the ability of Fintech Firms to develop, platforms that can offer services similar to Alipay, Ant Check Later, Baizhong and Baidu Wealth Management.

This is predominately related to, regulation around, accessing consumer data and the dominance of established banks in the USA, UK and the EU. Fintech’s, in the UK and the EU, cannot scale their value propositions, without entering into partnerships, with leading retail banks.

Regulators, in the EU introduced the Second Payments Services Directive II (PDS2) and the Open Banking Standard. To create an environment for banks and start-ups in the Fintech space to deliver innovative products and services centred around consumer data.

To understand why Fintech ecosystems in China developed on a different path to their western counterparts. Read the previous blog post titled, “Digital Wallets & the Distruption of Financial Services”.

However, to illustrate the dilemma, US, UK and EU, Fintech firms face. In China, ANT Financial, a global digital financial services platform. Has more than 450 million clients, ten times the numbers served by any one of the world’s largest banks, and the equivalent of 60% of the number of bank accounts in China.

The organisation is part of Alibaba, and its’ on a mission is to provide the world with equal access to financial services. Presently, 30% of the world’s adult population is unbanked, 80% of SME’s worldwide has no access to formal financial systems and 90% of the adult population in developing countries do not have access to a credit card.

The firm offers data- empowered Fintech solutions for SME’s and consumers. Through its portfolio of services, centred around; wealth management (303m users), financing (100m users) and insurance solutions (392m users). Digital identities, in the form of facial recognition is one of the innovations deployed by the platform to mitigate the risk of fraud.

This encompasses, face, eye-print, voice and finger print. Currently the firm deploys facial recognition technology for authentication purposes for 150 million users, the process takes less than 3 seconds.

Also, blockchain technologies are used to enhance trust for charitable donations and for mutual insurance plans. 355 charity programmes are run on this platform. For both applications the fraud rate loss is less than o.001%. Ant Financial valuation is US$150bn, higher than Santander, RBS and the CommonwealthBank.