Online Travel Marketplaces

Travel Consumers Evolving Search Habits

The most trusted tools utilised by consumers when researching services online, are search, at (71%), TV at (69%) and social media at (68%). There is a big dip from social media to newspapers (45%), Magazines (32%) and Blogs (28%).

However, in the travel industry consumers, search behaviours are diverging, from the norm. Travellers intent on booking flights, hotel accommodation, and car rentals, or plan to holiday in resorts. Are bypassing search engines altogether and instead are selecting online marketplaces as their first port of call when searching for a holiday destination.

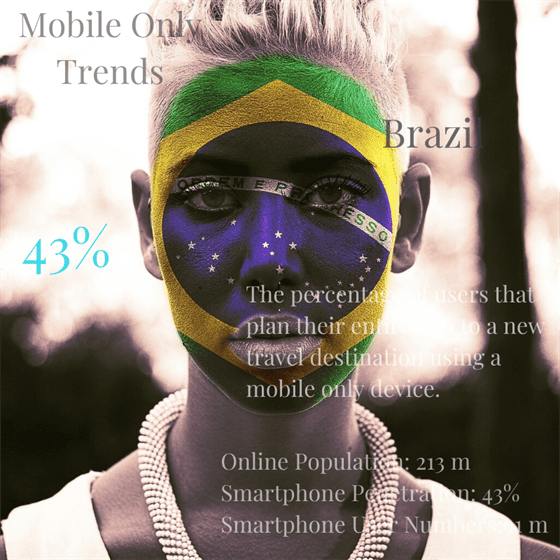

Mobile Only Trends

Also, the mobile-only phenomenon is beginning to take hold in the travel sector. According to research conducted by Google Think and PhocusWright. A significant percentage of smartphone owners across the globe are actively researching, booking and planning their entire trip using a mobile device.

TOP 50 COUNTRIES BY SMARTPHONE USERS & PENETRATION

Jan 2018

If one, compliments this research with smartphone penetration across the globe there is still room for growth in mobile only transactions via smartphones. In countries like India and Brazil smartphone penetration is still below 50%. Estimated to be 28.5% and 42.8% respectively in 2018.

The advent of big data, and machine learning is providing immense opportunities for organisations that manage structured and unstructured data. To better forecast and predict consumer behaviour.

Enabling the proprietors, of online marketplaces to more effectively service travel consumers, and the organisations that comprise their partner networks.

However, creating the necessary, infrastructure, organisational capabilities, machine learning models, algorithms and governance structures necessary to compete. Is fraught with complexity.

One key area that online marketplace proprietors believe demands immediate attention to enable them to better serve their partners and shoppers that visit their platforms.

Is improving the accuracy of their forecasting and predictive capabilities, across key elements of their business models. Customer service, sales, marketing, logistics, and finance.

Data Ninjas

The proprietors of online marketplaces handle on average millions of transactions per day across in some instances in hundreds of countries, in multiple languages and currencies.

To illustrate, Intent Media is a small travel marketplace, in comparison to the leviathans; like booking.com, and Ctrip with it’s 300 million users.

However, this firm still handles 1 billion, individual searches each month across hundreds of travel sites and turns millions of data signals, such as; intent, the number of searches, and locations, into inputs that can accurately predict the propensity to purchase in real time.

On the other hand, the Booking.com marketplace, comprises of 1.5 million properties on its website in over 220 countries and territories on its various websites, in over 40 languages.

Of the I.5 million properties, 396,000 include hotels, motels and resorts. Complimented by approximately 1.1 million homes, apartments.

Digital travel sales worldwide will reach US$694.4bn in 2018 according to eMarketer. In the United Kingdom, the figure is set to reach £29.56bn. The ease of mobile payments and the growing trend in online travel consumers conducting all their travel activity via their smartphones is fuelling growth.

Allied Market Research estimates that the global luxury hotel market is expected to be worth U$20.4bn by 2022.

According to E&Y when online consumers search the web for information their first port of call are search engines. In fact, 71% stated that when they commence their online customer journey search engines are still their first choice.

As of April 2017, according to Statista, the Google search engine accounted for (87.74%) of all UK searches, Bing accounted for (10.07%) and Yahoo! (3.16%).